How To Find Inflation Rate With Price Index

The Price of a Basket of Goods

Effigy 1. A literal marketplace handbasket of goods.

If inflation is the per centum change of the price level, what is the "toll level"? When economists talk near the cost level, what they mean is the boilerplate level of prices. To calculate the toll level, they brainstorm with the concept of a market basket of goods and services. Imagine a weekly trip to the grocery store. Think about the items you identify in your shopping cart (or basket) to buy. That is your market basket. More formally, when economists talk about a market basket of goods and services, they are referring to the different items individuals, businesses, or organizations typically buy.

The adjacent stride is to identify the prices of those items, and create a weighted average of the prices. Changes in the prices of goods for which people spend a larger share of their incomes will matter more than changes in the prices of goods for which people spend a smaller share of their incomes. For example, an increase of 10% in the rental rate on housing matters more to most people than whether the price of carrots rises past 10%. To construct an overall measure of the price level, economists compute a weighted average of the prices of the items in the handbasket, where the weights are based on the actual quantities of goods and services people buy.

Alphabetize Numbers

The numerical results of a calculation based on a basket of appurtenances can become a little messy. To simplify the task, the price level in each period is typically reported as anindex number, rather than as the dollar corporeality for buying the basket of goods. Index numbers are unit of measurement-free measures of economic indicators. Index numbers are based on a value of 100, which makes information technology easy to measure out per centum changes. We'll explicate this shortly.

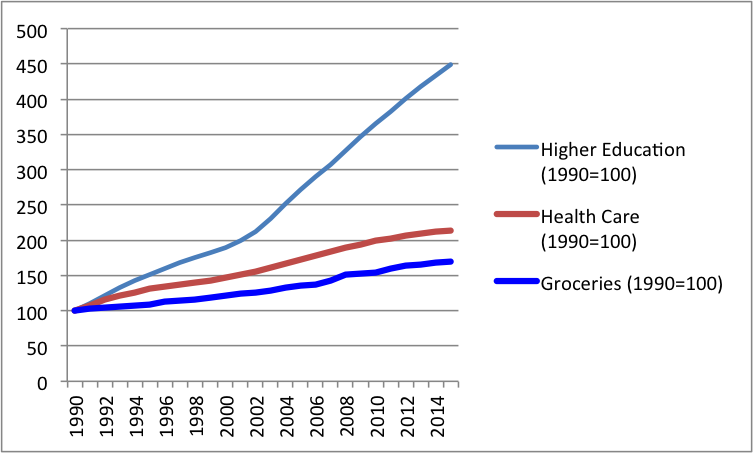

Index numbers for prices are chosen price indices. A toll index is substantially the weighted average of prices of a sure type of good or service. Price indices tin measure out a narrow range of goods and services or a broader range of goods and services. There are price indices for eating place meals, for groceries, for consumer goods and services, or for everything included in GDP. Figure 2 shows cost indices for U.S. higher education, healthcare and groceries, for the menstruum 1990-2015, which are computed by the Bureau of Economic Analysis in the U.Due south. Commerce Section. Each price index has a base of operations year of 1990 and increases over time. The price index for groceries increased by 70% over the 25-yr period. Y'all can see this since the price alphabetize increased from a value of 100 in 1990 to a value of 170 in 2015. The cost index for healthcare increased by 213% over the same period, and the price alphabetize for higher education, which includes tuition, room, board, textbooks and other fees, increased most 450% over the period.

Figure two. Cost Indices for U.S. Higher Teaching, Healthcare & Groceries (1990-2015).

Toll indices are created to assist calculate the pct alter in prices over time. To convert the coin spent on the basket to a cost index, economists arbitrarily cull one year to be the base of operations yr ,or starting indicate from which we mensurate changes in prices. The base year, by definition, has an index value equal to 100. This sounds complicated, just it is actually a simple math trick.

Let's look at a simple case.

Computing a Cost index

Suppose we expect at a simple basket of goods consisting of hamburgers, aspirin and movie tickets, three items that a college student might buy. Say that in any given calendar month, a college student typically purchases 20 hamburgers, one bottle of aspirin, and v movies. Prices for these items over iv years are given below. Prices of some goods in the basket may rise while others autumn. In this example, the price of aspirin does not change over the four years, while movies increase in price and hamburgers bounce up and down. Each yr, the cost of buying the given basket of appurtenances at the prices prevailing at that fourth dimension is shown.

To calculate the price index in this example, outset compute how much money is spent on each skillful in Year ane.

| Year i | Amount | Toll | Total |

| Hamburgers | 20 | $3 | $threescore |

| Aspirin | 1 | $10 | $10 |

| Movies | 5 | $6 | $thirty |

Next compute the total cost of the market basket in Year 1:

$60 + $10 + $30 = $100

Next, do the same computations for Years two through 4.

| Yr 2 | Amount | Price | Full |

| Hamburgers | 20 | $3.20 | $64 |

| Aspirin | 1 | $10 | $10 |

| Movies | 5 | $6.50 | $32.fifty |

Total cost of the market handbasket in Yr 2:

$64 + $x + $32.l = $106.l

| Year 3 | Amount | Toll | Total |

| Hamburgers | 20 | $3.10 | $62 |

| Aspirin | 1 | $ten | $10 |

| Movies | 5 | $seven | $35 |

Total cost of the market basket in Year 3:

$62 + $10 + $35 = $107

| Year 4 | Amount | Price | Total |

| Hamburgers | 20 | $3.50 | $64 |

| Aspirin | 1 | $x | $10 |

| Movies | five | $7.50 | $37.50 |

Total cost of the market basket in Twelvemonth 4:

$70 + $10 + $37.fifty = $117.l

These computations are summarized in Table 1.

| Table 1. A Higher Student's Basket of Appurtenances | ||||

|---|---|---|---|---|

| Items | Hamburger | Aspirin | Movies | Total Cost of Market Basket |

| Qty | 20 | ane bottle | 5 | — |

| Twelvemonth 1 Price | $iii.00 | $10.00 | $6.00 | — |

| Twelvemonth 1 Corporeality Spent | $60.00 | $10.00 | $xxx.00 | $100.00 |

| Yr 2 Price | $3.20 | $10.00 | $6.50 | — |

| Year 2 Amount Spent | $64.00 | $10.00 | $32.50 | $106.50 |

| Year 3 Cost | $3.10 | $10.00 | $7.00 | — |

| Twelvemonth 3 Corporeality Spent | $62.00 | $ten.00 | $35.00 | $107.00 |

| Year four Toll | $3.50 | $10.00 | $7.50 | — |

| Year 4 Amount Spent | $70.00 | $10.00 | $37.50 | $117.50 |

At present, the total cost of the marketplace basket in each year is not quite a price index, considering we oasis't established a base of operations yr. Say that Year 3 is chosen as the base year. Since the total amount of spending in that year is $107, we split that amount past itself ($107) and multiply by 100. Mathematically, that is equivalent to dividing $107 by 100, or $ane.07. Doing either volition give u.s. a value for the price index in the base year of 100. Again, this is considering the index number in the base twelvemonth always has to have a value of 100. Then, to effigy out the values of the price alphabetize for the other years, nosotros divide the dollar amounts for the other years by 1.07 also. Notation as well that the dollar signs cancel out so that price indices take no units. Calculations for the other values of the price index, based on the example presented in Table 1 are shown in Table two.

| Table 2. Calculating Price Indices When Year 3 is the Base Yr | |||

|---|---|---|---|

| Total Spending | Toll Index | ||

| Year ane | $100 | [latex]\frac{100}{1.07}=93.4[/latex] | |

| Year ii | $106.50 | [latex]\frac{106.50}{1.07}=99.5[/latex] | |

| Year three | $107 | [latex]\frac{107}{1.07}=100.0[/latex] | |

| Year four | $117.fifty | [latex]\frac{117.50}{1.07}=109.viii[/latex] | |

Effort It

From Price Indices to Inflation Rates

An inflation rate is just the per centum change in a price index. An aggrandizement rate can be computed for any toll alphabetize using the full general equation for percentage changes between two years, whether in the context of aggrandizement or in any other calculation:

[latex]\displaystyle\frac{(\text{Level in new year}-\text{Level in previous yr})}{\text{Level in previous year}}=\text{Percentage change}[/latex]

From Year 1 to Year 2, the price index in Tabular array two rises from 93.4 to 99.v. Therefore, the pct modify over this time—the inflation rate—is:

[latex]\displaystyle\frac{(99.v-93.4)}{93.4}=0.065=half-dozen.five\text{ per centum}[/latex]

From Twelvemonth two to Year iii, the cost rises from 99.5 to 100. Thus, the inflation charge per unit over this time, again calculated by the per centum change, is approximately:

[latex]\displaystyle\frac{(100-99.5)}{99.five}=0.0047=0.47\text{ percent}[/latex]

From Yr 3 to Year 4, the overall cost rises from 100 to 109.viii. The inflation rate is thus:

[latex]\displaystyle\frac{(117.50-100)}{100}=0.098=ix.8\text{ pct}[/latex]

These calculations are summarized in Table 3.

| Table 3. Calculating the Inflation Rate from the Toll index | |||

|---|---|---|---|

| Price index | Inflation Charge per unit | ||

| Year 1 | 93.4 | ||

| Yr two | 99.v | [latex]\displaystyle\frac{(99.five-93.four)}{93.iv}=0.065=half dozen.v\text{ pct}[/latex] | |

| Year 3 | 100 | [latex]\displaystyle\frac{(100-99.5)}{99.5}=0.005=0.5\text{ percent}[/latex] | |

| Year four | 109.8 | [latex]\displaystyle\frac{(109.8-100)}{100}=0.098=9.eight\text{ percent}[/latex] | |

This calculation of the change in the total cost of purchasing a handbasket of goods takes into business relationship how much is spent on each good. The issue is equivalent to creating a weighted average of the prices of the three items, with the weights being the percentage of the college student's budget made up by each item. The inflation rate, then, is the percentage change each year in the weighted average of prices.

Closing Thoughts on Price Indices

Iii points to remember: first, the inflation rate is the same whether it is based on dollar values or price indices, so then why bother with the price indices?

The inflation calculations we performed above were all based off the the price indices. For example, in year three the inflation charge per unit was calculated this mode:

[latex]\displaystyle\frac{(100-99.five)}{99.5}=0.005=0.5\text{ per centum}[/latex]

Note that we could also get to this number by computing aggrandizement rates equally the percent change over time in the cost of the market basket. For example, from menses 2 to period three, the overall change in the cost of purchasing the basket rises from $106.50 to $107. Thus, the inflation rate over this time, calculated by the percentage change, is approximately (note that 0.47 rounds upwards to 0.5):

[latex]\displaystyle\frac{(107-106.l)}{106.50}=0.0047=0.47\text{ percent}[/latex]

The advantage of using price indices over the costs of the market handbasket is that indexing allows easier eyeballing of the inflation numbers. If you lot glance at two annual values for a price index like 107 and 110, you know automatically that the rate of inflation between the two years is about, but not quite exactly equal to, 3%. By contrast, imagine that the cost levels were expressed in accented dollars of a large basket of goods, and so that when you lot looked at the data, the numbers were $19,493.62 and $20,009.32. Most people observe it difficult to eyeball those kinds of numbers and say that it is a change of about iii%. However, the two numbers expressed in dollars are exactly in the same proportion of 107 to 110 as the previous example. If you lot're wondering why uncomplicated subtraction of the index numbers wouldn't work, read the post-obit feature.

Why do yous not just subtract index numbers?

A word of warning: when a cost index moves from, say, 107 to 110, the charge per unit of inflation is not exactly 3%. Remember, the inflation rate is non derived by subtracting the alphabetize numbers, but rather through the per centum-change calculation. The precise inflation rate as the cost index moves from 107 to 110 is calculated as (110 – 107)/107 = 0.028 = 2.viii%. When the base year is adequately close to 100, a quick subtraction is not a terrible shortcut to calculating the inflation rate—just when precision matters down to tenths of a percent, subtracting will not requite the correct respond.

Second, index numbers have no dollar signs or other units attached to them. Although cost index numbers are used to calculate a percentage inflation rate, the alphabetize numbers themselves practise not accept percentage signs. Index numbers just mirror the proportions found in other data. They transform the other data so that the data are easier to work with.

Third, the pick of a base year for the alphabetize number—that is, the year that is automatically fix equal to 100—is capricious. It is chosen as a starting point from which changes in prices are tracked. In the official inflation statistics, it is common to use one base year for a few years, and then to update it, so that the base twelvemonth of 100 is relatively close to the present. Only whatsoever base of operations year that is called for the index numbers will result in exactly the same aggrandizement rate. To see this in the previous case (Table 1), imagine that Year 1, when full spending was $100, was also chosen equally the base year, and given an index number of 100. At a glance, you tin can see that the index numbers would now exactly match the dollar figures, the aggrandizement rate in the commencement catamenia would be 6.5%, and and so on.

Watch Information technology

Lookout the iv minute clip from this video to review the stardom between price indices and inflation rates.

You can view the transcript for "Price Indices and Inflation- Macro two.4" here (opens in new window).

Try It

Glossary

-

- base year:

- capricious year whose value as an alphabetize number is defined as 100; aggrandizement from the base of operations year to other years can easily be seen by comparing the index number in the other yr to the alphabetize number in the base year—i.east., 100; so, if the index number for a twelvemonth is 105, then there has been exactly 5% inflation between that year and the base year

- index number

- a unit of measurement-free mensurate of an economical indicators; index numbers are based on a value of 100, which makes it easy to measure percent changes

- Inflation rate:

- The percentage change in some price alphabetize

- marketplace basket:

- hypothetical drove of goods and services (or more precisely, the quantities of each good or service) consumers typically buy

- price indices:

- essentially the weighted average of prices of a sure type of good or service; price indices are created to calculate the inflation rate, i.east. the per centum modify in prices over time

- price level:

- the boilerplate level of prices

Did yous have an idea for improving this content? We'd beloved your input.

Source: https://courses.lumenlearning.com/wm-macroeconomics/chapter/tracking-inflation/

Posted by: brittonpretage58.blogspot.com

0 Response to "How To Find Inflation Rate With Price Index"

Post a Comment